The Big Gamble on Tariff Policy

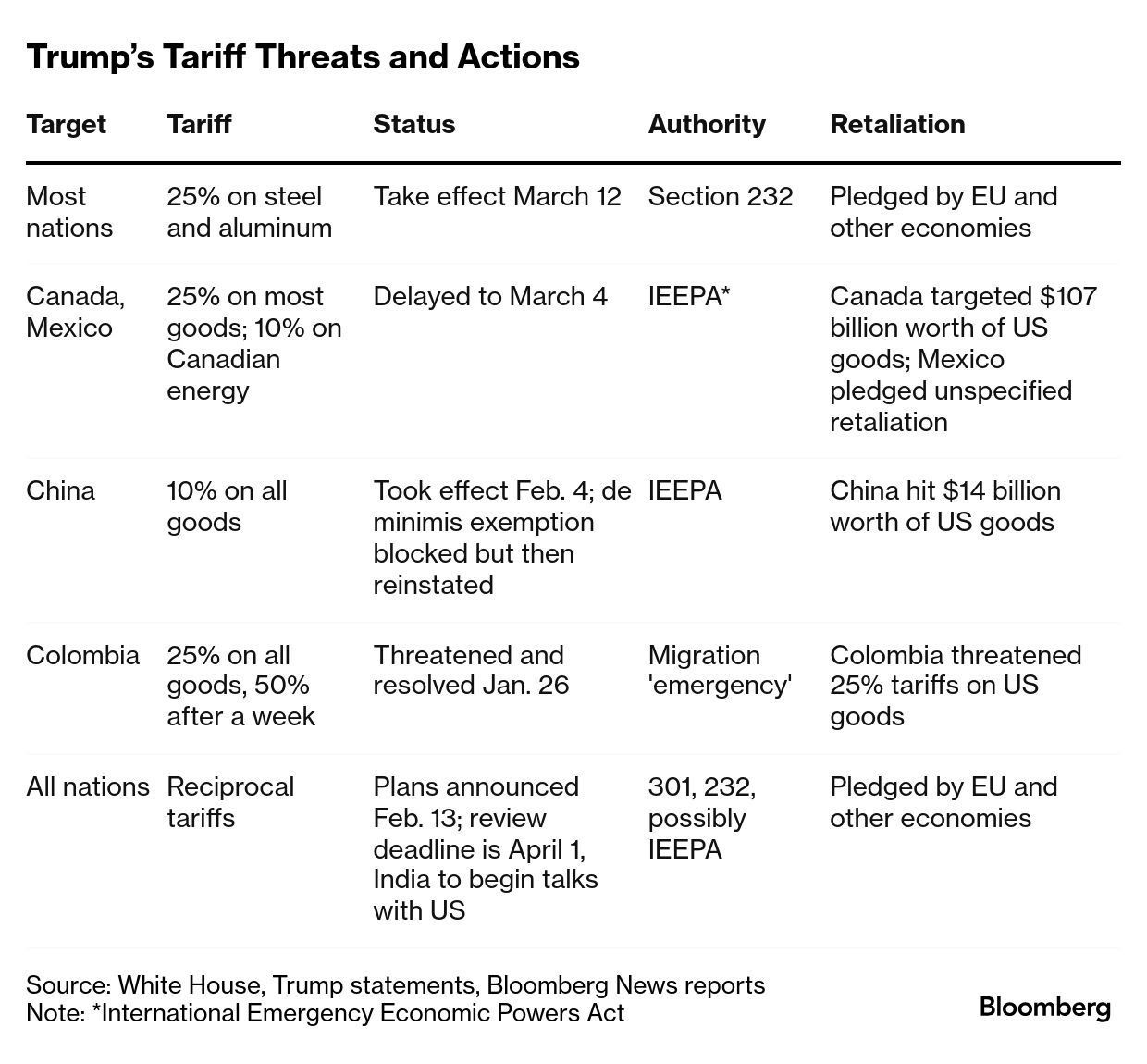

Uncertainty rages about which — if any — of President Donald Trump’s threatened tariffs on imports into the U.S. will actually come into effect, and when. Companies that do business in the U.S. are holding off on capital expenditures, exploring new places for manufacturing and sourcing, and running extensive what-if scenarios, all in order to try to stay ahead of the competition.

In order to pull away from endless (and expensive) speculation, SupplyChainBrain talked to a range of industry experts to figure out what happened the last time Trump introduced punitive tariffs, and how differently things might play out in in his second administration.

“After tariffs went through [in 2018], there was a big shift in production volume outside of China; to Vietnam, Indonesia, Thailand and South and Central America. And that’s been gradually increasing every year,” says Joseph Firrincieli, sales manager at OEC Group New York, a global freight forwarder that specializes in trans-Pacific trade. “Now it’s going to happen even more. At the time, it was just China. Now it’s more widespread, including Mexico and Canada.”

So far, however, those shifts in global trade have not brought manufacturing back into the United States, which has long been Trump’s stated intention.

“Without having a full picture, it’s hard to say whether tariffs themselves will bring back jobs,” says Steve Austin, CEO of Manufacturing Corporation of America (MCA), which buys and agglomerates legacy manufacturers in the U.S. Austin points to important elements such as funding for research and development, as well as tax breaks that offset investments in manufacturing and other infrastructure, such as under the Tax Cuts and Jobs Act (TCJA), which is already being sunsetted, and will expire at the end of 2025. “It’s the overall economic plan that dictates whether there will be more manufacturing jobs in the U.S.,” he says.

While tariffs have long been a normal instrument of trade, the widespread effects — particularly when those tariffs are sudden and aggressive — have proved hard to predict and control.

“Last time [Trump] put tariffs on aluminum and steel to boost U.S. steel and maybe sales worldwide," says Simon Geale, executive vice president at Proxima, a procurement and supply consulting firm that's part of Bain & Co. "But what happened was that U.S. companies saw an opportunity to put prices up and close the gap between their own steel and imported steel. And then foreign buyers put their own tariffs on U.S. steel. So half of what you wanted to come true came true, and the other half didn’t go how you wanted it. And downstream industries, those using steel, were reported to suffer from increased costs leading to reduced demand, which reportedly offset any job gains a few times over through employment cuts. So ultimately it was consumers who lost out.”

Arash Azadegan, professor and vice chair of the Supply Chain Management Department at the Business School at Rutgers University, agrees that consumers are likely to feel the pinch in terms of price rises because of the new tariffs. “The administration is smart enough to know that that's what’s going to happen," he says, "but the purpose is something larger than that,” he says.

All seem to agree that Trump is trying to boost the American economy by eradicating trade deficits through tariffs. During an interview for a podcast by The New York Times February 18, White House senior trade adviser Peter Navarro, also known as Trump’s Tariff Czar, argued that an increase in wages, combined with tax cuts and greater foreign investment in U.S. businesses, would put enough money in American pockets to offset rising prices. “If real wages rise faster than any other types of inflation, people are still better off,” he said.

Trump himself seems to have backed off his election promises to bring prices down on Day 1. “We may have short term, some, a little pain,” he told reporters on February 16. “And people understand that."

But that could be a dicey bet. “They think it’s taking your medication, but there are side effects,” says Azadegan. He points out that higher costs were part of the effect when Trump introduced a 25% tariff on foreign steel in 2018, and they weren’t purely in line with the rise in costs of production. Azadegan says the average increase in cost in terms of materials per automobile was $400-$600, but the actual price of a car went up three times that much. “It’s a big enigma, other than to suggest that many firms across the supply chain kind of hedged their bets in preparation," he says. "We see that happening in other areas. Any time there’s turbulence, there’s hedging going on.”

As an example, Azadegan cites the way the cost of a gallon of gas goes up immediately when the price of a barrel of oil increases, but what consumers pay at the pump takes much longer to fall when the oil market drops. “That’s a form of hedging,” he says.

Economists observe that American wages are already high compared to those in countries that make most of what’s in our homes and offices. The federal minimum wage is $7.25, and the average wage in manufacturing increased to $28.55 per hour in January, according to the U.S. Bureau of Labor Statistics. While recent statistics are hard to come by, estimates of hourly manufacturing wages in China are around $6, and in Mexico, somewhere south of $4.50.

So even if a 25% tariff on all imports from Mexico is implemented, that might still not have the intended effect, notes Austin. “I don’t even know if that would be enough to discourage companies from nearshoring," he says. "As a manufacturer, you’ve got to look at the whole picture — low wages, cheap land and easy transport into the U.S. market. If the product is still cheaper even with the tariffs in place, it’s still going to be made in Mexico.”

Azadegan says the reason Trump is acting so rapidly — instead of getting new tariffs approved by Congress, as they are usually supposed to be — is that he has a short window before he loses the political capital he gained in the November, 2024 election. “The psyche of the consumer is, they’re going to say, ‘It’s okay.’ And then, six months down the road, they’ll say, ‘Enough is enough,’ and they’re going to snap.”

Geale agrees. “During the pandemic and aftermath, we were talking about inflation, disruption, labor costs, energy costs, government subsidies, geopolitical uncertainty and tariffs,” he says. “The net effect was that prices were going up, but consumers didn’t know where to point their anger. Now, it’s going to be one thing. That’s an absolute key difference.”

What to Do?

Azadegan advises that businesses take a wait-and-see approach when it comes to making major decisions about manufacturing and sourcing. “In the long run, I don’t think a couple of months of delay in terms of long-term investments are going to make that much of a difference,” he says, pointing out that it takes 12 to 18 months to get an auto plant in Mexico up and running. “Given the turbulence there is in terms of decision-making, and the adjustments that are going to have to be made, a delaying tactic is probably the best way forward.”

Meanwhile, manufacturers can bake in uncertainty by adding extra costs to pricing models. “It’s the equivalent of holding on to inventory,” Azadegan says. “In a way, we have a perfect storm here, because prices are going up and consumers are getting used to [it], so now any manufacturer in any business can say that there’s inflationary pressure. Even though they could keep prices lower, they now can build in a buffer, just in case they have to pay tariffs.”

More than one expert believes that the increased uncertainty and disruption in the world — and therefore in supply chains — means businesses need to work together more. “Collaborating with suppliers or even competitors is going to be very important,” says Mauro Erriquez, a senior partner at McKinsey & Company. He points to Catena-X, an end-to-end, collaborative and open-data ecosystem for industry that counts among its members traditionally cutthroat competitors such as Volvo, Volkswagen, Mercedes-Benz and Renault; along with ThyssenKrupp, Siemens and BASF. “They are basically trying to define protocols for data exchange, where they can share information about the supply chain across companies and industries,” he says.

Technology, including artificial intelligence, can help, Erriquez adds. “We’re inviting clients to really go back to analytics. The only way of reacting is to increase your agility. I tell them: You need to become like a cat. You need to see stuff in the night earlier than others, and add an amazing reaction speed,” he advises. “In supply chain, you need to actually understand and get an earlier view of problems arising, and that’s only possible, in the U.S. or anywhere, when you have a digitized view of your supplier and your suppliers’ suppliers.

“You can run a web-scraping tool to give you more regular insights into what’s happening in the market,” Erriquez continues. “It’s far easier than before; any company is not able to do that on paper or Excel. You can use generative AI to ask questions about your supply chain, and identify which are the most critical elements.”

Still, it’s going to be tough to know how best to counter what Ford Motor Co. chief executive officer Jim Farley described as “costs and chaos,” at a Wolfe Research conference February 11. “It’s obvious that many organizations are in a holding pattern, because no matter what you do, there’s a 50% chance that you’ll do the wrong thing,” says Azadegan.

And the options are limited. “Importers are going to have to move fast to find factories in other countries that can make the same goods at the same quality and at same price,” says Firrincieli. “That’s going to be huge for mom-and-pop companies, especially.”

“You decide not to trade with the U.S., or you build in U.S., or you build in a friendshoring country," says Geale. "But it’s very difficult to determine, right now, who’s your friend. Now we’re in a state of ‘whereshoring’ because it’s so unpredictable.

From a short-term perspective, Trump "seems to be creating the uncertainty he wanted in order to create confidence in America’s economic strength," Geale says. "But in the long term, we’ll see the real effects of all this.”

All in all, there’s a new mindset at the helm of U.S. trade policy, and businesses will just have to get used to it. “Trump is a deal-maker at heart, and from my perspective the one thing he’d like to see on his tombstone was that he got American industry firing again,” says Geale. “He makes his negotiations out in public rather than in private — that’s one of the key differences. He creates a lot of emotional tension. He makes the first move in every negotiation with some big — some would say unachievable — statement, such as annexing Canada. He’s unpredictable!”